Golden Star Resources Publishes Positive Feasibility Study for Prestea Underground Mine West Reef Project

TORONTO -- (Marketwired) -- 06/11/13 -- Golden Star Resources Ltd. (NYSE MKT: GSS) (TSX: GSC) (GHANA: GSR) ("Golden Star" or the "Company") is pleased to announce the results of a positive Feasibility Study prepared by an independent party, SRK (UK) Ltd., to develop its Prestea Underground Mine West Reef Project in Ghana. The Feasibility Study estimates the project will produce an average of 66,000 ounces ("oz") of gold per annum over its six year production life, with steady-state production of approximately 80,000 oz per annum for four of those years.

Highlights of Prestea Underground Mine West Reef Project (1, 2, 3, 4)

- Probable Mineral Reserve of 1.43 million tonnes ("Mt") at a grade of 9.61 grams per tonne ("g/t") for 443,000 oz of gold before recoveries;

- Indicated Mineral Resource of 0.87 Mt at a grade of 18.3 g/t for 507,000 oz of gold inclusive of the Probable Mineral Reserves;

- Inferred Mineral Resource of 0.51 Mt at a grade of 11.6 g/t for 190,000 oz of gold;

- Total project capital costs of $150.1 million: comprising $90.6 million initial capital; $35.8 million capitalized operating cost; and $23.7 million sustaining capital;

- Post-tax Internal Rate of Return ("IRR") of 23% at $1,500/oz gold (at $1,400/oz gold, IRR is 19%);

- Net Present Value ("NPV") at a 5% discount rate of $114 million at $1,500/oz gold (at $1,400/oz gold, NPV is $87 million);

- Total project life of 9 years, including a 3 year pre-development period prior to production;

- Cash operating costs of $734/oz gold; and

- Payback period is 3 years from the start of production.

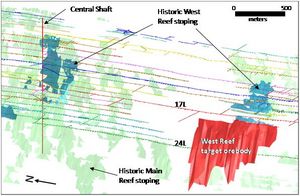

The Feasibility Study demonstrates positive economics for the extraction of the West Reef steeply dipping, high-grade, narrow vein deposit using mechanized cut-and-fill mining with footwall ramp access. The mining target lies at a depth of 600 m to 950 m below surface, between 17L and 24L, about 2 km to the south of the Prestea Mine Central Shaft (Figure 1). Initial access to the orebody for preparation work will be via the Central Shaft and 17L. Two new raise-bored shafts are planned to be developed in the immediate vicinity of the West Reef to provide primary access, ore hoisting, and intake/exhaust ventilation.

Sam Coetzer, President and CEO of Golden Star, commented, "We are pleased with the encouraging results of the Feasibility Study. The West Reef is a high-grade mineralized zone with ore that is suitable for processing through our existing Bogoso oxide plant, reducing the risk associated with putting this project into production. We are also excited to have this project in the Company's pipeline as it demonstrates our ability to execute on our strategy, which is to grow our non-refractory production ounces at lower operating costs. The Feasibility Study also allows GSR to add to its non-refractory reserve base. Additionally, it should be noted that there continues to be upside in the down plunge direction on the West Reef."

Financial Analysis

Golden Star has used a base case gold price of $1,500/oz for the preparation of the Feasibility Study. The base case financial analysis indicates an IRR of 23%, an NPV at a 5% discount rate of $114 million and a payback period of 3 years from the start of production.

----------------------------------------------------------------------------

Financial Analysis

----------------------------------------------------------------------------

Internal Rate of Return (IRR) 23%

Net Present Value at 5% discount (NPV5%) $114 million

Gold price assumption $1,500/oz

Sales revenue $598 million

Operating costs $257 million

Operating profit (EBITDA) $341 million

Capital Costs

Capitalized operating cost $35.8 million

Total initial capital $90.6 million

Total sustaining capital $23.7 million

Operating Costs

Mining $125.4/t-milled

Processing $20.5/t-milled

G&A $19.3/t-milled

Refining $1.5/t-milled

Contingency $16.7/t-milled

Royalty $20.9/t-milled

Total operating cost $204.3/t-milled

Total operating cost (excluding capitalized operating cost) $179.3/t-milled

Life of Mine Production Data

Ore mined 1,434,000 tonnes

Ore dilution (waste/(waste+ore)) 43%

Development waste meters 18,007 m

Head grade (diluted) 9.61 g/t

Gold content in ore 443 koz

Metallurgical recovery 90%

Ounces sold 399 koz

----------------------------------------------------------------------------

Upside and downside sensitivities to gold price for NPV and IRR are presented on the table below:

------------------------------------------------------------------

Gold Price ($/oz) NPV5%($ million) IRR

------------------------------------------------------------------

1,700 169 29%

1,600 141 26%

1,500 (Base case) 114 23%

1,400 87 19%

1,300 59 15%

------------------------------------------------------------------

Project Location and Infrastructure

The Prestea concession is located in the western region of Ghana, approximately 200 km from the capital Accra and 50 km from the coast of the Gulf of Guinea. The Prestea Underground Mine West Reef Project is in an area where mining has occurred continuously since the late 1800s. The Prestea Underground Mine West Reef Project is the expansion of an existing underground mining operation. Therefore, most of the required services, infrastructure and community support are already in place:

- Surface access to the mine is via the public road network that extends onto the site;

- Surface infrastructure in the area consists of a variety of government, municipal and other roads with good overall access;

- Electricity and water are available - electricity from the Ghanaian national grid is currently used to power the existing Prestea Mine surface and underground infrastructure, water comes from surface and underground sources;

- Processing of the mineralized material is planned to be carried out at Golden Star's existing oxide plant at Bogoso, 16 km to the northeast of the Prestea Mine; and

- Tailings storage will be in Golden Star's existing and permitted Bogoso Mine tailings storage facility.

Mining

The primary access to the orebody will be via a new 4.7 m diameter raise-bored access shaft from surface equipped with man/material and skip hoists. The raise-bore chips will be removed from the mine via the Central Shaft which will also provide access to the area for pre-development work. A 3.8 m diameter shaft will also be raise-bored to provide exhaust ventilation for the project.

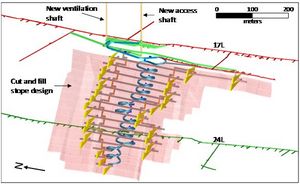

The proposed ore extraction method is a mechanized cut and fill underground method utilizing waste rock fill material sourced from underground development and cemented waste fill in areas where a level will be undercut by future stoping.

A footwall ramp, footwall bypass drifts and stope ramps will provide access to the stopes as shown in Figure 2.

Single boom jumbos will be implemented for production ore drilling and blasting and ground support will be installed with hand-held drilling equipment. Small 1.5 m(3) underground load haul dump machines ("LHDs") will be used to clean broken ore from the stopes and to introduce backfill material. Larger LHDs will be used for development mucking and for loading ore into 30 t trucks for haulage up to the loading pocket.

The hoisting system has a capacity of 1,500 tonnes per day ("tpd"), which provides for: 800 tpd of ore; waste as required by the mining cycle; and additional capacity for expansion in the future.

Metallurgy and Processing

Metallurgical test work, carried out at Lakefield SGS under SRK (UK) Ltd. supervision, indicates that the diluted Prestea Underground Mine West Reef Project ore can be processed through the Bogoso oxide plant in a blend with Bogoso non-refractory open pit ore where it is expected to achieve recoveries in excess of 90%.

Given the high-grade (~10 g/t Au) and production rate (800 tpd) of the West Reef ore, compared to the Bogoso oxide plant capacity (~3,000 tpd) and design feed grade (< 2 g/t Au), the preferred processing strategy for treating the West Reef ore through the Bogoso oxide plant will be as a blend with other, lower-grade non-refractory ore sources. As the West Reef ore is not highly preg-robbing (gold re-absorbing) it will be readily amenable to blending with other non-refractory ore sources.

The test work has indicated that the processing cost for the West Reef ore should not be significantly different to the current Bogoso oxide plant processing cost.

Mineral Reserves

The Probable Mineral Reserves reported here have been estimated in compliance with definitions set out in NI 43-101.

-----------------------------------------------------------

West Reef Reserves Tonnes Gold Grade Oz

-----------------------------------------------------------

(M) (g/t) (000's)

Proven - - -

Probable 1.434 9.61 443

-----------------------------------------------------------

Notes to the Mineral Reserve table:

(i) The Prestea Underground Mine West Reef Mineral Reserve was estimated using a $1,500/oz gold price and an economic gold cut-off of 4.7 g/t.

(ii) The Qualified Person reviewing and validating the estimation of the Mineral Resources is Michael Beare, Corporate Consultant, SRK (UK) Ltd.

(iii) Since Golden Star reports its Mineral Reserves to both NI 43-101 and SEC Industry Guide 7 standards, it is possible for the Company's Mineral Reserve figures to vary between the two. Where such variance occurs it will arise from the differing requirements for reporting Mineral Reserves. For the Mineral Reserves reported here, there is no difference between the Mineral Reserves as disclosed under NI 43-101 and those disclosed under SEC Industry Guide 7, and therefore no reconciliation is provided.

Mineral Resources

The Indicated and Inferred Mineral Resources have been estimated in compliance with definitions set out in National Instrument 43-101 of the Canadian Securities Administrators ("NI 43-101").

The following table summarizes Prestea Underground Mine West Reef Project's estimated Indicated Mineral Resources and Inferred Mineral Resources as of year-end 2012:

------------------------------------------------------------

West Reef Tonnes Gold Grade Oz

Resources

------------------------------------------------------------

(M) (g/t) (000's)

Indicated 0.862 18.27 507

Inferred 0.508 11.62 190

------------------------------------------------------------

Notes to the Indicated Mineral Resource and Inferred Mineral Resource table:

(i) The Prestea Underground Mine West Reef Project's Mineral Resource was estimated using a $1,750/oz gold price and an economic gold cut-off of 3.08 g/t.

(ii) The Qualified Person reviewing and validating the estimation of the Mineral Resources is Dr John Arthur, Principal Consultant, SRK (UK) Ltd.

(iii) Indicated Mineral Resources are inclusive of Probable Mineral Reserves.

Cautionary Note to Investors Concerning Estimates of "Indicated Mineral Resources" and "Inferred Mineral Resources"

This section uses the terms "Indicated Mineral Resources" and "Inferred Mineral Resources." The Company advises US investors that while these terms are recognized and required by NI 43-101, the US Securities and Exchange Commission ("SEC") does not recognize them. US Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into a higher category or into Mineral Reserves. Inferred Mineral Resources have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. US Investors are cautioned not to assume that any part or all of the Inferred Mineral Resource exists, or is economically or legally mineable. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Also, disclosure of contained ounces is permitted under Canadian regulations; however the SEC generally requires Mineral Resource information to be reported as in-place tonnage and grade.

Environmental, Permitting and Community Relations

The Prestea Underground Mine West Reef Project enjoys broad community support. The longer term socio-economic benefits to the community of employment and the associated socio-economic spin-offs are broadly acknowledged by Prestea residents as a crucial economic engine for the community. The development of some of the mitigation strategies for the surface expression of the project involved a community committee that guided the approach and provided successful outcomes. The environmental controls proposed for the construction and mining phases of the project mean that noise, vibration, and air quality (valued socio-economic community components), and all other regulated parameters are expected to meet all the regulatory requirements.

The resettlement action plan for Golden Star's Prestea projects was submitted to the regulatory authority for review and approval in November 2012. The environmental impact statement is being finalized and will be submitted to the Ghana Environmental Protection Agency for review and approval.

Financing

With the Feasibility Study now completed, discussions will commence with a number of project debt, equity, equipment, and other finance providers to fund the Prestea Underground Mine West Reef Project to full production.

Opportunities

Underground drilling in the West Reef area is currently underway to upgrade Inferred Mineral Resources and to identify extensions of the known gold mineralization to the north following the high-grade shoot down plunge below 24 Level.

Qualified Persons

The scientific and technical data contained in this news release pertaining to the Prestea Underground Mine West Reef Project has been reviewed and approved by the following Qualified Persons under NI 43-101, who consent to the inclusion of their names in this release. The Feasibility Study was prepared by SRK (UK) Ltd., under the supervision of the following personnel:

- Michael Beare, C.Eng. - Overall FS compilation, mining, reserve estimate and financial;

- Dr. John Arthur, C.Geol. - Mineral Resource estimate;

- Neil Marshall, C.Eng., - Underground geotechnical;

- Dr. John Willis, MAusIMM (CP) - Metallurgical and process;

The personnel listed above have reviewed and approved the scientific and technical contents of this press release.

Notes to this press release:

1. All currency figures are expressed in US dollars, unless noted otherwise.

2. Base case gold price for the Feasibility Study is $1,500/oz.

3. Indicated and Inferred Mineral Resources have been estimated at an economic cut-off grade based on a gold price of $1,750 per ounce for December 31, 2012, and on economic parameters deemed realistic.

4. Cash operating costs per ounce represent the mine site operating costs such as mining, processing, ore transport, refining and site general and administration expenses, and are exclusive of amortization, reclamation, capital, and exploration and development costs.

Detailed Report

The NI 43-101 Technical Report, Prestea Underground West Reef Feasibility Study, will be filed within 45 days on SEDAR at www.sedar.com and will be also available at that time on Golden Star's corporate website at www.gsr.com.

Company Profile

Golden Star Resources holds the largest land package in one of the world's largest and most prolific gold producing provinces. The Company holds a 90% equity interest in Golden Star (Bogoso/Prestea) Limited and Golden Star (Wassa) Limited, which respectively own the Bogoso/Prestea and Wassa/HBB open-pit gold mines in Ghana, West Africa. In addition, Golden Star has an 81% interest in the currently inactive Prestea Underground mine in Ghana, as well as gold exploration interests elsewhere in Ghana, in other parts of West Africa and in Brazil in South America. Golden Star has approximately 259 million shares outstanding.

Statements Regarding Forward-Looking Information:

Some statements contained in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. Such statements include plans for the development of the Prestea Underground Mine; estimates of mineral reserves and mineral resources; estimates concerning cash operating costs, gold prices, recovery rates, ounces of gold produced, net present values (including assumed discount rates), the internal rate of return, payback periods, life of mine and production data, levels of investment and capital cost necessary to bring the Prestea Underground Mine into production; mining methods and access plans at the Prestea Underground Mine and expected processing of mined material and tailings storage; and the submission of the environmental impact statement. Investors are cautioned that forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual facts to differ materially, including timing of and unexpected events at the Prestea Underground Mine; variations in grade of mineralized material; delay or failure to receive government approvals and permits; the availability and cost of electrical power and key inputs; timing and availability of external financing on acceptable terms; technical, permitting, mining or processing issues; fluctuations in gold price and costs; and general economic conditions. There can be no assurance that future developments affecting the Company will be those anticipated by management. Please refer to the discussion of these and other factors in our Form 10-K for 2012. The forecasts contained in this press release constitute management's current estimates, as of the date of this press release, with respect to the matters covered thereby. We expect that these estimates will change as new information is received. While we may elect to update these estimates at any time, we do not undertake to update any estimate at any particular time or in response to any particular event.

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2334194

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2334196

For further information, please contact:

GOLDEN STAR RESOURCES LTD.

Jeff Swinoga

Executive Vice President and Chief Financial Officer

1-800-553-8436

INVESTOR RELATIONS

Belinda Labatte

The Capital Lab, Inc.

647-427-0208

Greg DiTomaso

The Capital Lab, Inc.

647-427-0208