Pacific Potash Corp to Merge With Cowley Mining Plc to Become Largest Publicly Listed Land Holder in the Amazon Potash Basin

Vancouver, British Columbia - August 27th, 2013 - Pacific Potash Corp. (TSX-V: PP; OTCQX: PPOTF; FSE: P9P, "Pacific Potash", "the Company") is pleased to announce that on August 27, 2013, it has entered into an agreement in principal to merge (the "Transaction") with Cowley Mining Plc ("Cowley"). If completed, the merger will effectively make Pacific Potash the holder of the second largest land holdings in the Amazonas Potash Basin and similar in size to, the land separately controlled by Petrobras and Brazil Potash.

The parties also intend to raise up to $12 million in equity financing for the merged entity to be completed upon closing of the Transaction.

Highlights

-Cowley's land holdings could potentially host expansive potash deposits based on historical data and based on recent discoveries found within the basin.

-Part of Cowley's landholdings are immediately adjacent to Brazil Potash (inferred resource of 381Mt @ 31.2% KCl based on the latest corporate presentation given by Ercosplan and NI 43-101 compliant) and Petrobras deposits, Fazendinha and Arari - *cautionary note* Fazendinha and Arari deposits estimates were presented as reports to the Mineral authority in Brazil and based on 29 and 23 drill holes respectively, a qualified person has not done sufficient work to classify the historical estimate as current mineral resources and the issuer is not treating the historical estimate as current mineral resources as defined by NI 43-101.

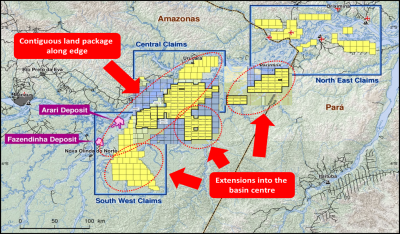

-Combined entity to become the largest publicly listed land rights holder in the Amazon Potash Basin (see map below).

-Brazil is the 3rd largest potash consumer globally - consuming 8.1Mt in 2012 and expected to grow to 13-14Mt by 2020 - but is dependent on imports by over 90% of annual demand, whereas domestic supply could offer a transportation cost advantage.

Cowley is a widely-held, unquoted junior exploration company headquartered in the Isle of Man with corporate offices in Brasilia, Brazil, and London, UK. No shareholder holds a controlling interest in Cowley.

Cowley is focused on the exploration and development of three potash exploration claim blocks in the states of Amazon and Para, Northern Brazil, East of Manaus. Cowley holds approximately 929,000 hectares extending over the Amazonas Potash Basin including areas adjacent to proven Petrobras and Brazil Potash deposits. According to Cowley's unaudited financial information for the financial year ended December 12, 2012, Cowley had a cash position of approximately US$675,000, with a net asset value of approximately US$1.18 million. Its major liabilities consisted of a loan facility and convertible notes in the aggregate amount of approximately US$1.4 million.

Cowley's license areas are subject to historic work consisting of 31 wells and 2,095km of 2D seismic, focused on Oil & Gas exploration, which resulted in a strong potential for the development of potash deposit as the ones already identified within the basin. *cautionary note* there is no certainty further exploration will lead to the development of deposits similar to the Petrobras and Brazil Potash deposits.

Advantages of Merger

The combined entity ("the Merge-Co") following the completion of the merger transaction will have the following main value drivers:

-The Merge-Co will have the 2nd largest land holdings in the basin (1,725,041 hectares) similar to the land packages separately held by Petrobras and Brazil Potash.

-The Merge-Co's management and advisory team will have over 300 years of combined mineral exploration and mining experience, primarily with expertise in potash primarily located in the Amazon Basin.

-The financial assets of the companies will be combined. In addition, the resulting company will have better access to sources of funding in the capital markets particularly in Europe, Asia, North America and Brazil.

-The merger will reduce competition in the basin and leave two major active players--Brazil Potash and Pacific Potash.

-Merge-Co will benefit from economies of scale ensuring that administration, operations and other costs will be streamlined.

-Joint management is anticipating commencing drilling in September as previously planned by Pacific Potash's exploration team.

-As a result of combined resources, the merger will greatly enhance our ability to complete the major six well drill program presently budgeted to cost $10 million.

Mr. Balbir Johal, Executive Co-Chairman and Director of Pacific Potash said "The Merger will make the new company stronger and better. That is the greater value for all stakeholders. Together with Cowley, we will have a stronger exploration team in Brazil, connections to greater sources of finance capital in Asia, Europe, North America and Brazil and a common vision to build an extraordinary company."

Mr. Oliver Polcher of Cowley Mining Plc stated "Cowley considers the planned combination with Pacific Potash to be consistent with our mission to build a first-class potash project in Brazil. We believe that by combining our expertise, adding to each other's global reach and consolidating our land packages in the Amazonas Potash Basin we may create a stronger value proposition for investors and ultimately deliver returns for all stakeholders involved."

Transaction Summary

The Transaction is expected to be effected by way of a plan of arrangement, share offer exchange or other arrangement, whereby the shareholders of Cowley (the "Cowley Shareholders") will exchange their shares for common shares in Pacific Potash on the basis that will result in the Cowley Shareholders owning 37.5% of the issued and outstanding common shares of Pacific Potash upon completion of the Transaction. As such, the effective rate of exchange is expected to be approximately 0.2267 Pacific Potash share for each Cowley share. Each party will be responsible for their own cost with respect to this Transaction.

Pacific Potash currently has an issued and outstanding share capital of 109,400,396 common shares. As a result, following the completion of the Transaction, the Company would have 175,040,634 common shares issued and outstanding.

The parties to the Transaction are at arm's length. Following the completion of the Transaction, which cannot close until the required shareholder and Exchange approvals are obtained, it is anticipated that Pacific Potash will continue to be a Tier 2 mining issuer on the Exchange.

Given the intended concurrent Fundraising, as noted below, the Transaction will constitute a Reverse Takeover under the policies of the Exchange.

For the purposes of Rule 2.5(a) of the City Code on Takeovers and Mergers ("the Code"), in relation to the Transaction Pacific Potash reserves the right to vary the form and/or mix of the consideration and, with the recommendation or agreement of the Cowley board, the share exchange ratio.

In accordance with Rule 2.6(a) of the Code, Pacific Potash must, by not later than 5.00pm on September 24, 2013 either announce a firm intention to make an offer for Cowley in accordance with Rule 2.7 of the Code or announce that there is no intention to make an offer for Cowley, in which case the announcement will be treated as a statement to which Rule 2.8 of the Code applies. This deadline will only be extended with the consent of the Panel in accordance with Rule 2.6(c) of the Code.

Pre-Conditions to the Transaction

A firm intention to make an offer under Rule 2.7 of the Code is conditional on the satisfaction or waiver of mutual due diligence and execution of a definitive merger implementation agreement. This announcement is not an announcement of a firm intention to make an offer under rule 2.7 of the Code and there can be no certainty that an offer will be made even if these pre-conditions are satisfied or waived.

Fundraising for Merge-Co

Pacific Potash and Cowley also intend to carry out a fundraising by way of private placement for Merge-Co, to close upon completion of the Transaction (the "Fundraising"). The Fundraising would only be subject to regulatory approval. This would aim to raise up to $12,000,000 in gross proceeds by the issuance of 120 million units at $0.10 per unit. Each unit would consist of one common share of Merge-Co and one half of one Merge-Co common share purchase warrant. Each full Merge-Co common share purchase warrant would entitle the holder to purchase a further Merge-Co common share at a price of $0.17 for a term of 12 months from closing of the Fundraising. The proceeds of the Fundraising would be used to fund the exploration and development of potash exploration property in the states of Amazon and Para, Northern Brazil, East of Manaus and for general working capital following the completion of the Transaction. Subject to regulatory approval, it is anticipated that certain finders' fees will be paid in relation to the Fundraising. All the securities to be issued in the financing will be subject to a four month hold period. Assuming the Fundraising is fully subscribed, Merge-Co would have 295,040,634 common shares issued and outstanding.

If no Cowley Shareholders participate in the Fundraising, the aggregate percentage holding of issued and outstanding common shares of Merge-Co held by Cowley Shareholders upon completion of the Transaction would reduce from 37.5% to 22.2% (or 18.5% if all the common share purchase warrants above were exercised). The effective rate of exchange on completion of the Transaction would remain as approximately 0.2267 Pacific Potash share for each Cowley share, although Cowley Shareholders would be diluted by approximately 40.7% (or approximately 50.7% if all the common share purchase warrants were exercised).

Pacific Potash will be applying for an exemption from the sponsorship requirement pursuant to the policies of the Exchange.

For the purposes of Rule 2.5(a) of the Code, Pacific Potash reserves the right to vary the terms of the Fundraising with the recommendation or agreement of the Cowley board.

This announcement is being made with the agreement of Cowley.

Proposed Changes to Management and Directors

It is anticipated that the board of directors of Pacific Potash following the completion of the Transaction will be comprised of five individuals, four of which shall be nominated by Pacific Potash and one of which shall be nominated by Cowley Mining Plc.

The President & CEO of Cowley, Oliver Polcher will become CEO and a Director of the combined company. Andre Costa will move from his current CEO role to Chief Operating Officer and Chief Geologist. Tao Liu and Balbir Johal will remain as Executive Co-Chairmen and Directors.

Oliver Polcher has 18 years of business building and investment banking experience with a successful track record in corporate leadership positions, deal making and fund raising, of which he has spent the last 6 years in the Natural Resources Industry.

Since early 2011 he has been the President & CEO of privately-held Cowley Mining Plc. Before he was the CEO and Director of privately-held metals trading company Metalcorp Group with revenues of over US$300m in metals trading, secondary aluminium smelting and exploration projects in South Africa (manganese), Namibia (manganese) and Guinea (bauxite).

Previously, Oliver spent 7 years in investment banking with Deutsche Bank, JP Morgan and Schroders as well as co-founding Inquam Ltd., a privately-held technology investment fund with approx. US$500 million in equity.

About Cowley Mining Plc

Cowley is a privately-owned junior exploration company registered on the Isle of Man with corporate offices in Brasilia, Brazil, and London, UK. The Company is focused on the exploration and development of three potash exploration claim blocks in the states of Amazon and Para, Northern Brazil, East of Manaus. Cowley holds approx. 929,000 hectares extending over the Amazonas Potash Basin including areas adjacent to proven Petrobras deposits, Fazendinha and Arari.

About Pacific Potash Corporation

Pacific Potash Corp. trades on the TSX Venture Exchange under the symbol: PP, as well on the OTCQX under the symbol: PPOTF and on the Frankfurt Stock Exchange under P9P. Pacific Potash is engaged in the exploration and development of the Amazonas Basin Project and the surrounding potash claims targeting the Middle Amazonas Potash Basin, currently the host to multiple new exploration campaigns for potash. The Company also is exploring the Provost Potash Property and the surrounding potash claims targeting the prolific Prairie Evaporite Formation, which is host to multiple conventional and solution potash mines.

Investors are cautioned that, except as disclosed in the disclosure document to be prepared in connection with the Transaction, any information released or received with respect to the reverse takeover may not be accurate or complete and should not be relied upon. Trading in the securities of Pacific should be considered highly speculative. Trading in the common shares of Pacific will remain halted pending further filings with the Exchange. Additional information will be provided in subsequent news releases and prior to any resumption in trading.

The Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

We seek safe harbour.

On behalf of the Board,

Pacific Potash Corporation

Balbir Johal, LL.B

Executive Co-Chairman & Director

For further information, please visit our website at www.pacificpotash.com or contact our V.P of Corporate Communications, Mike Blady:

Mike Blady

Office: 604.895.7446

Email: mblady@pacificpotash.com

Andre Costa, P.Geo, CEO & President of Pacific Potash Corp. and qualified person for the purposes of NI 43-101, has reviewed and approved the preparation of the technical information in this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as "may," "will," "should," "anticipate," "plan," "expect," "believe," "estimate," "intend" and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Pacific Potash in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Pacific Potash's actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management's Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedar.com. Pacific Potash disclaims any obligation to update or revise any forward-looking information or statements except as may be required.

In accordance with Rule 2.10 of the Code, Pacific Potash confirms that, as at the close of business on 20 August 2013, it had 109,400,396 ordinary shares in issue. The International Securities Identification Number for the ordinary shares is CA 694781105 6.

Under Rule 8.3(a) of the Code, any person who is interested in 1% or more of any class of relevant securities of an offeree company or of any paper offeror (being any offeror other than an offeror in respect of which it has been announced that its offer is, or is likely to be, solely in cash) must make an Opening Position Disclosure following the commencement of the offer period and, if later, following the announcement in which any paper offeror is first identified. An Opening Position Disclosure must contain details of the person's interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any paper offeror(s). An Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made by no later than 3.30 pm (London time) on the 10th business day following the commencement of the offer period and, if appropriate, by no later than 3.30 pm (London time) on the 10th business day following the announcement in which any paper offeror is first identified. Relevant persons who deal in the relevant securities of the offeree company or of a paper offeror prior to the deadline for making an Opening Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1% or more of any class of relevant securities of the offeree company or of any paper offeror must make a Dealing Disclosure if the person deals in any relevant securities of the offeree company or of any paper offeror. A Dealing Disclosure must contain details of the dealing concerned and of the person's interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any paper offeror, save to the extent that these details have previously been disclosed under Rule 8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no later than 3.30 pm (London time) on the business day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or understanding, whether formal or informal, to acquire or control an interest in relevant securities of an offeree company or a paper offeror, they will be deemed to be a single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any offeror and Dealing Disclosures must also be made by the offeree company, by any offeror and by any persons acting in concert with any of them (see Rules 8.1, 8.2 and 8.4).

Details of the offeree and offeror companies in respect of whose relevant securities Opening Position Disclosures and Dealing Disclosures must be made can be found in the Disclosure Table on the Takeover Panel's website at www.thetakeoverpanel.org.uk, including details of the number of relevant securities in issue, when the offer period commenced and when any offeror was first identified. You should contact the Panel's Market Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as to whether you are required to make an Opening Position Disclosure or a Dealing Disclosure.

A copy of this announcement will be available on Pacific Potash's website at www.pacificpotash.com. The content of the website referred to in this announcement is not incorporated into and does not form part of this announcement.

Copyright (c) 2013 TheNewswire - All rights reserved.