Peak Resources Announces Scoping Study Delivers Very Positive Results

WEST PERTH, AUSTRALIA -- (Marketwire) -- 12/03/12 -- Peak Resources Limited (Peak) (ASX: PEK) (OTCQX: PKRLY), is pleased to announce the completion of the scoping study, including preliminary economic assessment on its 100% owned Ngualla Rare Earth Project in Tanzania. The Company is extremely encouraged by the confirmation of high returns, low cash costs, and the low capital cost required to bring the project into production.

WEST PERTH, AUSTRALIA -- (Marketwire) -- 12/03/12 -- Peak Resources Limited (Peak) (ASX: PEK) (OTCQX: PKRLY), is pleased to announce the completion of the scoping study, including preliminary economic assessment on its 100% owned Ngualla Rare Earth Project in Tanzania. The Company is extremely encouraged by the confirmation of high returns, low cash costs, and the low capital cost required to bring the project into production.Peak Managing Director Richard Beazley said, "The outcome of the scoping study confirms that Ngualla is indeed a leading and stand out project in the rare earth industry with excellent efficiencies in capex and opex driven by the deposit's dominant natural advantages. This study clearly delineates the strong value proposition of Ngualla and catapults its development ahead of other projects."

Highlights

- Strong economics with a base case pre-tax net present value of US$1.571 billion and an internal rate of return of 53%.

- Low capital cost requirement of US$400 million (excluding contingency) with a payback period within the first 3 years of production.

- Low operating cash costs of US$10.09 per kg Free on Board "FOB" for the first 5 years of production with an average cost of US$11.05 per kg over 25 years.

- Annual average revenues of US$361 million at 10,000 tonne equivalent rare earth oxide production.

- Scoping study mine plans based solely on the Indicated and Measured portions of the Mineral Resource.

- Significant opportunity and available resource to upscale production to 40,000 tonnes per annum and extend the mine life, as the base case scoping study mine plan exploits less than 10% of the total Mineral Resource.

- The highest grade large scale rare earth deposit in Africa and the fifth largest deposit outside of China.

- Mineralisation is not radioactive and has the lowest levels of uranium (18ppm) and thorium (43ppm) of any major rare earth deposit.

- Beneficiation and metallurgical process proven in laboratory test work with pilot plant work underway.

- Relatively simple metallurgical process utilising sulphuric acid leaching with no inherently troublesome acid cracking or baking requirements.

- On target to begin production in Q1 2016.

Physical and Financial Summary

The key physical and financial parameters that define the Ngualla Rare Earth Project value proposition are listed below in Table 1. These values strongly support the project as a low cost, long term producer of rare earth products for the world market.

Table 1 - Physical and Financial Summary

----------------------------------------------------------------------------

Average Annual Mine Production (after

ramp up) 325,000 tonnes

----------------------------------------------------------------------------

Life of Mine (LoM) 25 years

----------------------------------------------------------------------------

Average Grade (LoM) 4.35% REO

----------------------------------------------------------------------------

Average Grade for first 5 years 4.64% REO

----------------------------------------------------------------------------

Average Stripping Ratio (LoM) 3.34

----------------------------------------------------------------------------

Average Stripping Ratio for first 5

Years 0.73

----------------------------------------------------------------------------

Total REO Recovery 71%

----------------------------------------------------------------------------

Average Annual Equivalent REO Product Separated REO = 6,347 tonnes

(after Ramp-up) CeO2 Concentrate = 3,633 tonnes

Total REO Production = 9,980 tonnes

----------------------------------------------------------------------------

Capital Costs (Excluding Contingency) US$ 400M

----------------------------------------------------------------------------

Average (LoM) Cash Cost (FOB), Excluding

Amortisation, Depreciation, and US$ 11.05 / kg

Royalties. (C1 Cost)

----------------------------------------------------------------------------

Average (C1 Cost) for first 5 years of

full production US$ 10.09 / kg

----------------------------------------------------------------------------

Revenue (FOB)

Separated Products "Basket Price" US$ 52.34 / kg

CeO2 (concentrate) US$ 8 / kg

----------------------------------------------------------------------------

Discount Rate Applied 10%

----------------------------------------------------------------------------

IRR (Pre-tax and Royalties) 53 %

----------------------------------------------------------------------------

NPV (Pre-tax and Royalties) US$ 1.571 billion

----------------------------------------------------------------------------

Payback from production start-up In 3rd Year

----------------------------------------------------------------------------

The Ngualla Project

Located in the south west of Tanzania (Figure 1) the Ngualla Rare Earth Project is 100% owned by Peak Resources Limited. The deposit is a recent discovery with the maiden Mineral Resource of 170 million tonnes at 2.24% REO* announced on 29th February 2012 ranking it as the fifth largest rare earth deposit in the world outside of China.

The Company has continued to fast track the development of the project with the aim of being a low-cost, long term rare earth producer by Q1 2016. Significant milestones have been met since February, including a 'Proof of Concept' for the metallurgical process, a breakthrough in beneficiation testwork, targeted drilling in the high grade Bastnaesite Zone, and now positive results from the Ngualla scoping study and preliminary economic assessment.

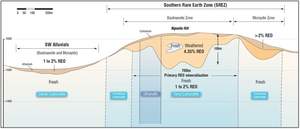

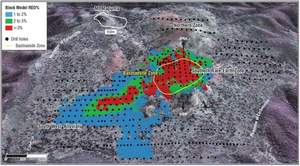

Mining

The positive results from the 'Proof of Concept' sulphuric acid leach process lead the study to identify that the optimum approach for Ngualla is to focus initial production from the highest grade, near surface weathered Bastnaesite mineralisation within the core of the Southern Rare Earth Zone (SREZ Figure 2). The zone offers low stripping ratios of less than 1 for the first 5 years of production, high grade mineralisation (averaging 4.35% REO) and low contaminants such as phosphate and calcium that would directly affect the leaching process.

The mining method will be conventional open pit, load, haul and dump utilising a fleet of small sized owner operated earthmoving fleet centred around a 70 tonne tracked excavator and three 40 tonne six wheel drive articulated dump trucks producing approximately 325,000 tonnes per annum. The pit optimization study undertaken as part of this study produced a set of nested internal pit stages that could be practically mined, whilst minimising waste movement and upfront costs. The initial mine life in this specific zone is 25 years.

The three stages are represented in Table 2 and Figure 3 below.

Table 2 - Staged Mining Schedule

----------------------------------------------------------------------------

Stage Mined REO % Waste kt Total kt Strip Ratio

Mineralisation

kt

----------------------------------------------------------------------------

1 516 4.83 102 618 0.20

----------------------------------------------------------------------------

2 1,631 4.71 720 2,350 0.44

----------------------------------------------------------------------------

3 6,092 4.21 26,687 32,778 4.38

----------------------------------------------------------------------------

TOTAL 8,238 4.35 27,509 35,748 3.34

----------------------------------------------------------------------------

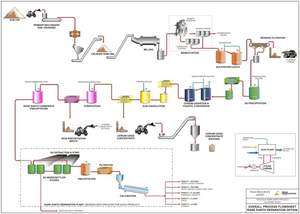

Beneficiation

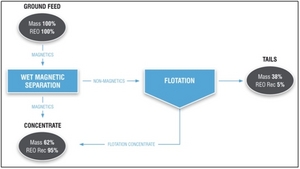

The process plant at Ngualla will comprise a front end beneficiation circuit which includes crushing, milling, magnetic separation and multiple stage flotation. This physical separation will achieve an estimated 53% mass rejection at 86% rare earth recovery. This significant mass rejection reduces both capital and operating costs by:

- Reducing the size of the sulphuric acid plant and acid leach stage of the recovery plant, and

- Substantially lowering sulphuric acid requirements -- the major contributor to reagent and operating costs.

Recovery

The beneficiation concentrate is sent to the rare earth recovery plant. This plant has the following features:

- The leaching reagent is 20% sulphuric acid that will be generated on site. This requires a comparatively small mass of non-hazardous sulphur to be transported to site for acid manufacture with the steam by-product available to supply the majority of the sites power needs.

-A large mass of waste material is rejected early in the flow sheet. This results in comparatively small equipment required for the downstream processes after the double sulphate precipitation.

- The production of a separate Cerium Oxide concentrate early in the process is an advantage in that it significantly reduces the size of the solvent extraction separation plant.

- Purification produces a rare earth chloride stream that can be fed directly to the solvent extraction separation plant.

- A high concentrate rare earth carbonate can also be produced following purification

- The rare earth recovery circuit has a high overall recovery of approximately 82%.

Separation

The rare earth separation plant will consist of five extraction circuits relating to the five required products. Each circuit will consist of loading, extraction, washing and stripping stages to produce a high purity rare earth solution of the specific product required. The rare earth will then be recovered from solution by precipitation as an oxalate before calcining to form the high purity oxide product. The final design and sizing of this circuit will be based on the pilot plant scheduled for operation at ANSTO in the first half of 2013.

Including the cerium oxide concentrate from the recovery plant, there will be six products averaging approximately 9,981 tonnes per year. The individual breakdown of this production is shown in Table 3.

Table 3 - Product Breakdown

---------------------------------------------

Product REO Production t/yr

---------------------------------------------

Ce Oxide (Concentrate) 3,633

---------------------------------------------

La Oxide 2,878

---------------------------------------------

Ce Oxide 1,072

---------------------------------------------

Pr/Nd Oxide 2,179

---------------------------------------------

SEG Oxide 194

---------------------------------------------

HRE Oxide + Y Oxide 24

---------------------------------------------

TOTAL 9,980

---------------------------------------------

Environmental

No significant unique, rare or endangered species of flora or fauna have been identified or reported by local people within the project area or transport corridors. Field assessments of the area will be undertaken as part of the Environmental and Social Impact Assessment (ESIA) due to be undertaken in 2013.

An assessment of the radiation levels of the mineralisation to be mined, as per the scoping study mine design, indicates that the levels of uranium (18 ppm) and thorium (43 ppm) equating to approximately 0.45 Bequerels per gram are less than half the level set by the International Atomic Energy Agency for mineral ores to be regarded as 'not radioactive'.

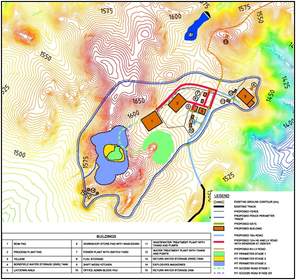

Infrastructure, Tailings and Services

A complete conceptual infrastructure and services design was undertaken as part of the scoping study (Figure 5). The design is based on the operation being completely self-sufficient. The majority of power will be produced through steam turbines generated from the sulphuric acid plant, water will be collected through either a local borefield or collection dam and all tailings and run off will be completely contained on site avoiding any possible environmental impacts off site.

Capital Cost

To reduce total risk and fast track the project, total engineering design and laboratory test work in most areas of this study go beyond the norm for a scoping level. The capital cost estimate is consistent with an AACE Class 4-type estimate with an accuracy of +/-30%. No contingency is included in the capital cost figure stated. It is normal practice for resource projects at the scoping study phase to assume a contingency figure of 35%.

Total project capital cost is estimated at US$400 million including for first fills and spares. The breakdown of these costs is shown in the following Table 4.

Table 4 - Capital Cost by Area

-----------------------------------------------------

AREA US$ Million

-----------------------------------------------------

Mine 8

-----------------------------------------------------

Beneficiation and Recovery Plant 68

-----------------------------------------------------

Sulphuric Acid Plant 59

-----------------------------------------------------

Separation Plant 64

-----------------------------------------------------

Tailings Facility 28

-----------------------------------------------------

Site Infrastructure 50

-----------------------------------------------------

Design Management & Construction 122

-----------------------------------------------------

Total 400

-----------------------------------------------------

Operating Costs

Operating costs for the Ngualla Project are estimated at $10.09 / kg of product for the first five years of production and averaging US$11.05 / kg over the life of the mine. The breakdown of these costs is shown in the following Table 5.

Table 5 - Operating Costs by Area

----------------------------------------------------------------------------

First 5 Years Full Prod. Average (LoM)

AREA US$ / kg product US$ / kg product

----------------------------------------------------------------------------

Mine 0.34 0.63

----------------------------------------------------------------------------

Beneficiation & Recovery 6.38 6.84

----------------------------------------------------------------------------

Separation 1.88 2.01

----------------------------------------------------------------------------

Tailings 0.20 0.22

----------------------------------------------------------------------------

Infrastructure 0.74 0.81

----------------------------------------------------------------------------

Product Transport (FOB) 0.55 0.55

----------------------------------------------------------------------------

Total 10.09 11.05

----------------------------------------------------------------------------

Rare Earth Pricing

For the purposes of this study the basket price used for the five separated high purity rare earth products is based on October 2012 (FOB) China prices as provided by Technology Metals Research and shown in Table 6.

Table 6 - Rare Earth Pricing Model

----------------------------------------------------------------------------

Relative Distribution

Rare Earth Oxide FOB Price (USD / kg) in Product (%) Value (USD)

----------------------------------------------------------------------------

La2O3 14 45.28 6.34

----------------------------------------------------------------------------

CeO2 15 15.92 2.39

----------------------------------------------------------------------------

Pr6O11 89 7.71 6.86

----------------------------------------------------------------------------

Nd2O3 89 26.24 23.36

----------------------------------------------------------------------------

Sm2O3 40 2.43 0.97

----------------------------------------------------------------------------

Eu2O3 1,943 0.44 8.60

----------------------------------------------------------------------------

Gd2O3 82 1.11 0.91

----------------------------------------------------------------------------

Tb4O7 1,511 0.08 1.15

----------------------------------------------------------------------------

Dy2O3 803 0.18 1.47

----------------------------------------------------------------------------

Ho2O3 0 0.14 0.00

----------------------------------------------------------------------------

Er2O3 0 0.00 0.00

----------------------------------------------------------------------------

Tm2O3 0 0.00 0.00

----------------------------------------------------------------------------

Yb2O3 0 0.00 0.00

----------------------------------------------------------------------------

Lu2O3 0 0.00 0.00

----------------------------------------------------------------------------

Y2O3 62 0.46 0.28

----------------------------------------------------------------------------

TOTAL

"Basket Price" 100.00 52.34

----------------------------------------------------------------------------

The price used for the cerium oxide concentrate is based on the October 2012 (FOB) China price of $15 for high purity cerium oxide discounted by 47% to adjust for the 65% purity of the product, resulting in an estimated price of US$8 / kg.

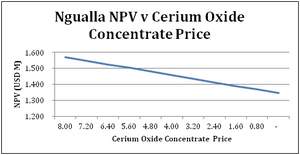

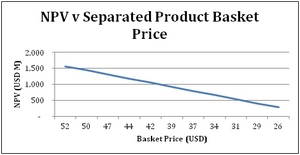

Due to the volatility of the rare earth market in recent years the following two sensitivity curves illustrate the robustness of the project against fluctuations in rare earth prices (Figure 6 and Figure 7).

Financial Evaluation

The project has a Net Present Value (NPV) of US$1.571 billion and Internal Rate of Return (IRR) of 53% using the base case average production rate of 10,000 tonnes of REO per annum and discount rate of 10%. Payback on initial capital expenditure occurs in the 3rd year of production.

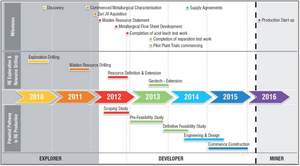

Preliminary Feasibility Study

The Ngualla Rare Earth Project remains on track to commence production in the first quarter of 2016 (Figure 8). The Preliminary Feasibility Study will begin with the construction of a pilot plant of the recovery process at Nagrom early in the New Year along with testwork by ANSTO laboratories on the separation process. Samples of the five (5) high purity REO products will be available for assessment by off take customers midway through 2013.

Optimisation of the metallurgical process is due to be complete by the end of December 2012. Further testwork will commence in January 2013 on an acid recycling process, to confirm early stage positive results. This is likely to reduce sulphuric acid consumption, the largest contributor to overall operating costs.

The preliminary feasibility study to be completed by quarter four of 2013 will determine the optimum development strategy for the project and incorporate the more detailed resource and geometallurgical model to be produced from the 2012 drilling program, as well as the testwork noted above. Two key areas that will also be assessed are the size of the operation with respect to annual production rates and the geographical location of the separation facility and the possibility of processing rare earth carbonates from other sources outside of Ngualla.

Mineral Resource Estimate

The Ngualla Rare Earth Project is a recent discovery with the first intersections in the Southern Rare Earth Zone (SREZ) reported in September 2010.

The maiden Mineral Resource estimate reported according to the 2004 JORC Code and Guidelines and completed for Peak by H&S Consultants Pty Ltd was reported on 29th February 2012, ranking Ngualla as the fifth largest Rare Earth deposit in the world outside of China. At a 1.0% lower grade cut-off for the combined Southern Rare Earth and South West Alluvial Zones the Mineral Resource estimate is:

170 million tonnes at 2.24% REO, for 3.8 million tonnes of contained REO.

Using a 3.0% lower grade cut, the total resource includes a higher grade near surface zone of:

40 million tonnes at 4.07% REO for 1.6 million tonnes of contained REO*

(* REO = total rare earth oxides including yttrium. See Table 7 for Mineral Resource classification details and Table 8 for breakdown of individual REOs).

The Mineral Resource is based on three phases of drilling comprising over 26,700m of drilling in 651 drill holes. The last phase of drilling was completed on 30th November 2011.

Table 7 - Classification of Mineral Resource for the Ngualla Rare Earth Project, 1.0% and 3.0% REO cut-off grades

----------------------------------------------------------------------------

Lower cut - off Resource Contained REO

grade Category Tonnage (Mt) REO (%)* tonnes

----------------------------------------------------------------------------

1.0% REO Measured 29 2.61 750,000

---------------------------------------------------------

Indicated 69 2.43 1,700,000

---------------------------------------------------------

Inferred 72 1.92 1,400,000

---------------------------------------------------------

Total 170 2.24 3,800,000

----------------------------------------------------------------------------

3.0% REO Measured 11 3.99 430,000

---------------------------------------------------------

Indicated 21 4.09 850,000

---------------------------------------------------------

Inferred 8.7 4.11 360,000

---------------------------------------------------------

Total 40 4.07 1,600,000

----------------------------------------------------------------------------

*REO (%) includes all the lanthanide elements plus yttrium oxides. Figures above may not sum precisely due to rounding. The number of significant figures does not imply an added level of precision.

Table 8 - Relative components of individual rare earth element oxides (including yttrium) as a percentage of total REO for the Ngualla Southern Rare Earth and Northern Zones ( > 1% REO).

--------------------------------------------------

Oxide % of Total REO

----------------------------------------------------------------------------

Light Rare Earths Lanthanum La2O3 27.1

--------------------------------------------------

Cerium CeO2 48.3

--------------------------------------------------

Praseodymium Pr6O11 4.74

--------------------------------------------------

Neodymium Nd2O3 16.3

--------------------------------------------------

Samarium Sm2O3 1.65

----------------------------------------------------------------------------

Heavy Rare Earths Europium Eu2O3 0.35

--------------------------------------------------

Gadolinium Gd2O3 0.78

--------------------------------------------------

Terbium Tb4O7 0.07

--------------------------------------------------

Dysprosium Dy2O3 0.17

--------------------------------------------------

Holmium Ho2O3 0.02

--------------------------------------------------

Erbium Er2O3 0.06

--------------------------------------------------

Thulium Tm2O3 0.00

--------------------------------------------------

Ytterbium Yb2O3 0.02

--------------------------------------------------

Lutetium Lu2O3 0.00

----------------------------------------------------------------------------

Other Yttrium Y2O3 0.52

----------------------------------------------------------------------------

Total % 100

--------------------------------------------------

(*= Mineral Resource block model at 1% REO cut)

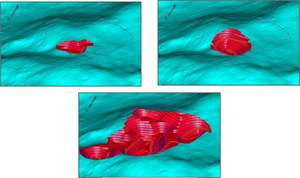

The scoping study is based on production from a central portion of the overall February 29th 2012 maiden Mineral Resource estimate referred to as the Bastnaesite Zone (Figure 9). Metallurgical test work completed by Peak has proved that the weathered mineralisation in this portion of the deposit is amenable to rare earth concentrate production via a simple sulphuric acid leach process with high leach extraction rates averaging 82%. The weathered or colluvial mineralisation within the Bastnaesite Zone used for the scoping study has both calcium and magnesium contents below 0.3%, phosphate levels of less than 0.5% and REO grades above 3%.

Only Indicated or Measured category Mineral Resource was used in the pit design and economic evaluation for the scoping study. No Inferred Mineral Resource was included.

Although usually mineralised to some extent, material outside this defined zone was effectively classified as 'waste' for the scoping study by attributing zero recovery of rare earths during the mining optimisation process.

Results from an additional 13,600m of drilling completed in 2012 will be used to complete an updated Mineral Resource estimate for the feasibility studies.

Metallurgical Development

Specialist rare earth metallurgy consultancy, Met-Chem Consulting, was retained in May of 2012 to manage the development of the Ngualla metallurgical flowsheet. In the ensuing 6 months, the development of the flowsheet included:

- Identifying that physical upgrading (beneficiation) of the mined material via crushing, milling magnetic separation and flotation is practical.

- Demonstrating that a high recovery (82%) of rare earths via sulphuric acid leaching, precipitation and purification to produce a high grade mixed rare earth carbonate is achievable.

- Separation of the rare earths into five high purity rare earth oxide products via classical solvent extraction techniques is viable.

Wet magnetic separation testwork undertaken at Nagrom in Perth proves that a further significant amount of waste can be removed before the processing stage, enabling operating cost savings due to the reduced sulphuric acid consumption.

The testwork was completed on a sample of diamond drill core composite (NDD007) and the ground feed was subjected to wet magnetic separation at increasing field strengths. The final non-magnetic stream consisted mainly of barite and silica minerals and was largely deficient in rare earths. Under the direction of Independent Metallurgical Operations (IMO) a specialised flotation regime was developed to further recover rare earths from the non-magnetic stream. This combined magnetic separation and flotation process proved effective at rejecting the non-magnetic barite and silica, which comprises 38% of the original feed mass and only 5% of the rare earths (Figure 10). Flotation testwork currently in progress is expected to enable a further upgrade. A mass rejection of 53% for a loss of only 14% of the rare earths is assumed for the scoping study.

Hydrometallurgical extraction and recovery of rare earths is possible via a number of processing routes. Four alternative routes were evaluated at Nagrom laboratories using Ngualla Southern Rare Earth Zone material with two routes developed through to a rare earth carbonate product.

Sulphuric acid baking was also evaluated, however this was rejected for the current scoping study on the basis of the following:

- It offered little improved recovery over acid leaching.

- Materials handling challenges of feeding the concentrate/acid "paste" into the kiln.

- Increased scrubbing requirements of the kiln off gasses in order to meet environmental standards.

- A high energy input into the kiln contributes to increased operating costs.

Ultimately the route chosen, based on simplicity, low operating cost and high rare earth recovery, was a sulphuric acid leach, double sulphate precipitation, purification, rare earth carbonate process.

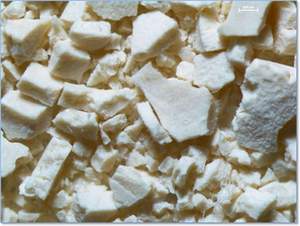

The process was demonstrated at laboratory scale producing a high purity (50% REO) mixed rare earth carbonate (Figure 12) along with a 65% cerium oxide concentrate and optimisation is almost complete.

The flowsheet has now been demonstrated to a degree much greater than that required at scoping study level.

The purified rare earth chloride solution produced during the development of the recovery process is typical of existing rare earth solvent extraction plant feeds and as such the process is expected to follow proven separation methods. ANSTO has commenced treatment of 1.6 tonnes of high grade material to produce a feed to the solvent extraction pilot plant due to commence in February 2013.

Cautionary Statement

The scoping study referred to in this report is based on low level technical and economic assessments, and is insufficient to support estimation and economic assessments, and is insufficient to support estimation of Ore Reserves or to provide assurance of an economic development case at this stage, or to provide certainty that the conclusion of the scoping study will be realized.

The use of the word "ore" in the context of this report does not support the definition of 'Ore Reserves' as defined by the 2004 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". The word 'ore' is used in this report to give an indication of quality and quantity of mineralised material that would be fed to the processing plant and is not to assumed that 'ore' will provide assurance of an economic development case at this stage, or to provide certainty that the conclusion of the scoping study will be realized.

Competent Person Statement

The information in this report that relates to Exploration Results is based on information compiled and/or reviewed by Dave Hammond who is a Member of The Australasian Institute of Mining and Metallurgy. Dave Hammond is the Technical Director of the Company. He has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Dave Hammond consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Mineral Resources is based on information compiled by Rob Spiers, who is a member of The Australasian Institute of Geoscientists. Rob Spiers is an employee of geological consultants H&S Consulting Pty Ltd. Rob Spiers has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Rob Spiers consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to metallurgical testwork results is based on information compiled and/or reviewed by Gavin Beer who is a Member of The Australasian Institute of Mining and Metallurgy. Gavin Beer a Consultant to the Company. He has sufficient experience which is relevant to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Gavin Beer consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

About Peak Resources

Peak is developing the Ngualla Project, a potentially low-cost, long term rare earth project located in south west Tanzania. Ngualla has been ranked as the fifth largest deposit in the world outside China, and the highest grade of the top seven.

Ngualla has a Mineral Resource of 170 million tonnes grading 2.24% of rare earth oxides (REO). Within the resource there is a highly weathered and near-surface zone estimated at 40 million tonnes at 4.07% REO, equivalent to 1.6 million tonnes of contained REO (see Table 1 below for resource classifications). Ngualla is also a bulk deposit which is largely outcropping. These attributes place the project among the world's most notable rare earth discoveries of recent years.

Ngualla is a potential low cost open pit mine due to its shallow outcropping high grade mineralization. The initial sighter metallurgical test work to date has been completed using a sulphuric acid leach process route suggesting a relatively less complex, potentially cheaper capital outlay and shorter time to production.

Safe Harbor Statement

The information in this document has been prepared as of October 15, 2012. Certain statements contained in this document constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward looking information under the provisions of Canadian provincial securities laws. When used in this document, the words "anticipate," "expect," "estimate," "forecast," "will," "planned," and similar expressions are intended to identify forward-looking statements or information.

Such statements include without limitation: statements regarding timing and amounts of capital expenditures and other assumptions; estimates of future reserves, resources, mineral production, optimization efforts and sales; estimates of mine life; estimates of future internal rates of return, mining costs, cash costs, minesite costs and other expenses; estimates of future capital expenditures and other cash needs, and expectations as to the funding thereof; statements and information as to the projected development of certain ore deposits, including estimates of exploration, development and production and other capital costs, and estimates of the timing of such exploration, development and production or decisions with respect to such exploration, development and production; estimates of reserves and resources, and statements and information regarding anticipated future exploration; the anticipated timing of events with respect to the Company's minesites and statements and information regarding the sufficiency of the Company's cash resources. Such statements and information reflect the Company's views as at the date of this document and are subject to certain risks, uncertainties and assumptions, and undue reliance should not be placed on such statements and information. Many factors, known and unknown could cause the actual results to be materially different from those expressed or implied by such forward looking statements and information. Such risks include, but are not limited to: the volatility of prices of gold and other metals; uncertainty of mineral reserves, mineral resources, mineral grades and mineral recovery estimates; uncertainty of future production, capital expenditures, and other costs; currency fluctuations; financing of additional capital requirements; cost of exploration and development programs; mining risks; community protests; risks associated with foreign operations; governmental and environmental regulation; the volatility of the Company's stock price; and risks associated with the Company's by-product metal derivative strategies. For a more detailed discussion of such risks and other factors that may affect the Company's ability to achieve the expectations set forth in the forward-looking statements contained in this document, see the Company's Annual Report on Form 20-F for the year ended December 31, 2011, as well as the Company's other filings with the Canadian Securities Administrators and the U.S. Securities and Exchange Commission.

The Company does not intend, and does not assume any obligation, to update these forward-looking statements and information. Marc Legault, a Qualified Person and the Company's Vice-President, Project Development, reviewed the technical information disclosed herein. For a detailed breakdown of the Company's reserve and resource position see the July 18th, 2012 press release on the Company's website. That press release also lists the Qualified Persons for each project.

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169545

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169543

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169550

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169553

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169556

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169559

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169548

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169561

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169565

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169563

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169568

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2169575

Contact:

Peak Resources Limited

Richard Beazley, Managing Director

Phone: +61-8-9200-5360

Email: richard@peakresources.com.au

MZ Group - North America

Derek Gradwell

SVP, Natural Resources

Phone: 949-259-4995

Email: dgradwell@mzgroup.us

Web: www.mzgroup.us

Figure 9 - Maiden Mineral Resource block model coloured by REO % grade and drill holes (as at the maiden Mineral Resource, 29th February 2012) on satellite image draped over topography, Ngualla Carbonatite.

[/url]Figure 11 - Simplified Sulphuric Leach Process and Solvent Extraction Separation Flow Sheet

[/url]Figure 11 - Simplified Sulphuric Leach Process and Solvent Extraction Separation Flow Sheet